Will corporate net-zero policies impact business travel?

The aviation industry accounts for approximately 2.5% of global carbon dioxide emissions, with this proportion remaining relatively stable for the last 30 years. While aircraft have become more fuel efficient in recent years, the growth in passenger volumes has more than offset these efficiency gains. Pre-COVID, passenger growth was ~6% per year while fuel efficiency gains were ~1% per year. As developing economies mature and GDP per capita increases, global passenger growth will likely accelerate.

Business travellers make up ~15% of passenger numbers, but their trips are materially more carbon intensive on a per seat basis. This is because first and business class seats take up more space on a plane and are heavier than economy seats. A long-haul business class flight emits roughly 3x the carbon of an economy flight on a per seat basis.

Companies with a high proportion of knowledge workers tend to have a lower carbon footprint with business travel their largest source of emissions. For example, PWC estimated that business travel contributed 90% of its emissions in 2019.

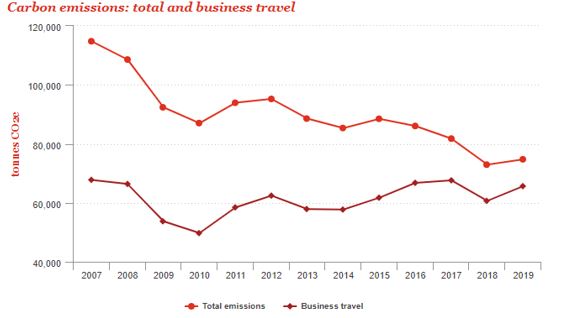

Business travel has grown as a proportion of PWC’s overall emissions:

Source: PWC

As more companies pledge to achieve “net zero”, business travel will become one of the most easily addressable sources of carbon emissions. Large companies such as Microsoft, EY, Salesforce, ABN Amro, HSBC and PWC, among many others, have made reducing business travel a core pillar of their emissions reduction plans. As the number of knowledge workers grows as a proportion of the overall workforce, it is likely that business travel will become a more prominent issue in the path toward net zero. According to Gartner, knowledge workers globally reached 1 billion in 2019, up from less than 500 million in 2012.

As the world was forced to adapt to COVID induced travel restrictions during 2020, we saw the rapid adoption of Zoom and other video conferencing solutions. In 2020 there were 45 billion webinar minutes hosted on Zoom, while annualised meeting minutes reached 3.3 trillion in the quarter to October 2020.

There has been a two-pronged benefit to the substitution from in-person to virtual meetings. Firstly, many companies saved a meaningful amount on travel – both Google and Amazon stated they had saved over $1bn in 2020 while HSBC stated it saved $300m. Secondly, there was a meaningful drop in emissions from the aviation industry during 2020. In Europe, aviation emissions fell 30%-60% in 2020 vs. 2019. Companies have recognised the benefits, with Microsoft estimating that the shift to virtual meetings for its MVP Global Summit in March 2020 eliminated nearly 5,000 metric tons of emissions, or the equivalent of taking 390,000 cars off the road for a day.

Given the financial and environmental benefits of reduced travel, many companies have suggested travel budgets will remain lower than pre-COVID levels as the world re-opens. Most companies have stopped short of firm targets. Others, such as banks HSBC and ABN Amro are targeting a 50% reduction in travel emissions relative to 2019, while the accounting firms PWC and EY are targeting a 35% per head reduction in travel emissions. The Financial Times estimated that a 50% cut in travel for the UK’s largest four banks compared to 2019 would save almost 120,000 tonnes of carbon emissions.

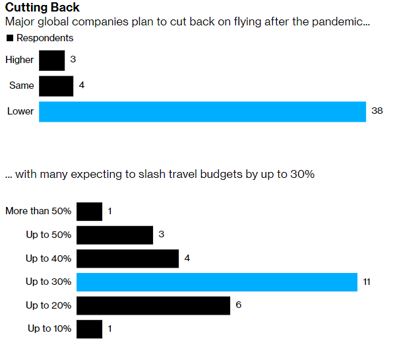

Surveys have suggested companies plan to reduce travel post-COVID:

Source: Bloomberg

It is difficult to predict what will happen to business travel volumes as the world re-opens. Predictions have ranged from a permanent impairment of 50% of activity (according to Bill Gates) to a full recovery as early as 2022. It is worth noting that 20%-25% of business trips are intra-company trips, which may, going forward, require a higher bar of justification given the successful adoption of video conferencing.

Business travellers generate outsized profits for airlines and hotels due to their shorter booking windows and lower price sensitivity. While busines travellers are typically less than 20% of volumes, they can account for greater than 50% of revenue and profits. For many travel focused companies, the meaningful return of business travel will be essential to reaching pre-COVID levels of profitability.

The rise of Zoom and other video conferencing and collaboration tools during COVID, as well as broader concerns about the carbon footprint of business travel complicates the recovery outlook, even as restrictions ease. Despite this uncertain future, many companies on the ASX that derive a substantial portion of earnings from business travel are trading at valuations higher than pre-COVID.

We expect a rebound in travel post-COVID and favour companies with a strong brand, tangible evidence of improving competitive dynamics, attractive valuations and decisive action plan on reducing emissions.

Author: Henry Hill, Investment Analyst