The long and the short of it: identifying shorting opportunities – part 2

WaveStone Capital takes an active high conviction approach to investing in quality Australian companies. The fundamental based analysis leads to identifying quality companies with superior corporate DNA. When conducting their analysis, the team also uncover companies that have less favourable traits and/or are overvalued.

In this latest update, WaveStone discusses our approach to shorting, along with two examples of company specific shorts the team has recently identified and executed that have delivered incremental return for investors in the WaveStone Dynamic Australian Equity Fund (Fund) over the last 12 months.

As a team, we are broadly optimistic on the ingenuity of Australian businesses and the long-term opportunities to generate return for our unitholders by investing in high quality companies with a sustainable competitive advantage. We are however realists and through consistent application of our investment process and adherence to valuation, we believe we can, at different times in the market cycle, add incremental value to investment returns by shorting individual stocks. Our approach to shorting takes a targeted fundamental approach to identifying weak and challenged businesses, deteriorating or disrupted industry environments and/or valuation bubbles.

With the bulk of investment returns generated from the long portfolio (positively disposed businesses) we do not believe our investors are best rewarded by taking aggressive and highly public crusades against identified short positions, as this might impinge on the ability to access company management.

Instead we prefer to provide our clients with some short case studies to help illustrate how we have identified and deployed individual short positions to add to investor returns. It is important to be aware shorting direct stocks involves increasing the gross exposure to the portfolio and it magnifies portfolio risk, and we don’t always get it right. We manage this risk by implementing stop loss if a stock appreciates beyond an acceptable level and limit the shorts by number and maximum position size.

Despite a positive start to the year, the 2018 calendar year was a tough year for investors, with the local equity market declining 3.1%. The local economic backdrop was challenging, with the consumer becoming more circumspect with falling house prices, and tighter bank lending standards starting to restrict credit in the shadows of the Royal Commission. Internationally slowing global growth, and the ongoing US/China trade dispute all impacted investor sentiment.

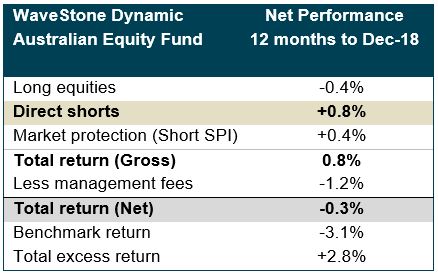

In this environment, the flexibility to both short individual stocks and to hedge the level of market exposure in the portfolio did tangibly add to returns. The contribution of this shorting and hedging technique to the Fund’s return is shown in the table below.

Source: WaveStone Capital

The following will detail two examples of direct stock short positions that have contributed to the Fund’s positive return over the year ending December 2018.

Invocare: (ASX: IVC)

Source: Invocare website. www.invocare.com.au

By way of background, Invocare is the largest funeral operator in Australia and New Zealand it operates under an umbrella of brands including key national brands White Lady and Simplicity as well as local independent offerings.

Since listing in 2003, the group has expanded its footprint through a steady stream of small bolt -on acquisitions. The network now consists of

290 funeral home locations and 16 cemeteries and crematoria, across Australia, and New Zealand with a small business in Singapore, with annual turnover of ~$470 million a year. Invocare had long enjoyed premium status among small and mid-cap managers with the perceived defensive nature of the earnings stream. The company historically has traded on a high multiple of around 25-30x earnings and was seen somewhat as a bond proxy.

At the beginning of 2018 there were several catalysts for us to build conviction in a short position in the company. We observed that the company’s earnings trajectory was slowing, however the very high Price to Earnings multiple had not fallen, signalling the shares were becoming more expensive. On closer examination it was apparent that prior management had over several years pushed pricing without reinvesting in facilities and service and had relinquished market share to its competitors. This approach occurred at the same time as a trend away from more formal, religious based ceremonies and greater pricing scrutiny of funeral arrangements through Internet price comparisons and media exposés.

The new management team recognised the vulnerability from a prolonged period of under- investment and launched a “Protect and Grow” investment strategy, which would require an investment of ~$200m.

Although this made strategic sense, it was clear to the WaveStone investment team that the business would probably go backwards in the short term due to network disruptions from site closures and refurbishment of tired facilities. With a high fixed cost base, profitability was susceptible to small reductions in volume. To compound this dislocation, tougher economic conditions resulted in a trend to lower priced services and more loss of market share.

Apart from the operational issues facing the business, the heavy “Protect and Grow” investment was putting more pressure on an already extended balance sheet. The company’s debt burden was further stretched by a sudden flurry of regional acquisitions. We considered these were aimed at filling an earnings hole, rather than representing the optimal use of capital. The debt burden also makes the company’s earnings even more vulnerable to any spike in interest rates.

In addition to these company specific issues, Invocare experienced a benign winter flu season which resulted in a below trend death rate in 2018. This magnified the company’s problems, at a time of maximum operational and financial vulnerability.

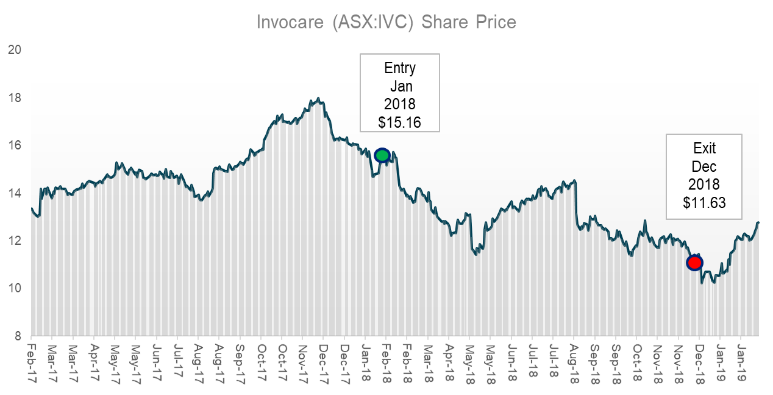

Over the course of 2018, IVC management effectively retreated from earlier earnings guidance, and the share price drifted lower. From WaveStone’s perspective the stock’s rating left little room for error, or valuation support. Thus, the combination of a challenging operating environment at a time of maximum business dislocation and a deteriorating balance sheet, saw the share price decline. Our thesis was correct, as shown in the chart below.

Source: Bloomberg

Based on average entry and exit prices, the short position generated 23% return over the 11 month holding period. We note that since closing out the position, the IVC share price has recovered to around $14 as of mid-March 2019, as investors responded to early signs of a recovery in the death rate. Our concerns over the balance sheet were validated with a $65 million capital raising. This case study helps illustrate how important timing is along with fundamental analysis and valuation discipline when it comes to shorting.

Domain: (ASX: DHG)

Source: Domain website. www.domain.com.au

Domain Holdings Group was a spin out from Fairfax Media in late 2017. The company owns and operates an online portal that delivers property marketing solutions for residential property and extends to cover new developments as well as commercial properties. They are the #2 player behind realestate.com.au.

The genesis of the short thesis emerged from our deep understanding of the banking sector, and the negative headwinds emanating from tighter credit conditions as well as government and regulatory policy changes aimed at capping investor participation and imposing extra charges on foreign purchasers.

This stock came onto our radars following the well-publicised downturn in the residential housing market. The downturn may eventually put pressure on advertising budgets, and as the #2 player we assess Domain to be more susceptible at the margin. A risk to the thesis was aggressive price increases by the company, but with falling property prices and longer selling campaigns, we assess DHG’s ability to pull the price lever to be limited to only a few distinct areas.

We identified that Domain was disproportionately exposed to the Sydney and Melbourne metropolitan residential markets. These markets have suffered the largest fall in property prices and had the greatest exposure to new high-density residential developments which are facing a likely downturn as foreign buyers and local investors show reduced appetite for more product.

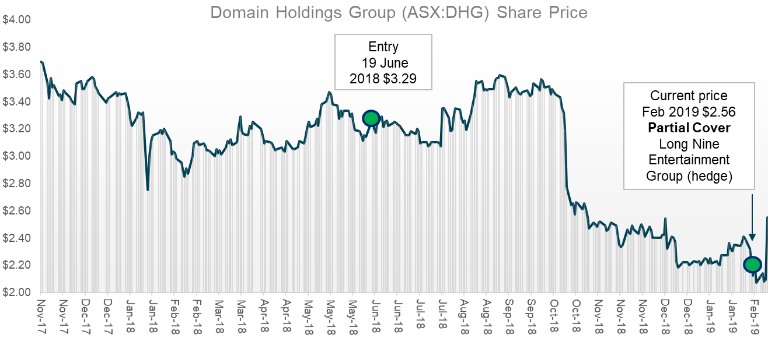

A short position was established in mid 2018 as we considered the stock’s valuation was not adequately reflecting the deteriorating operating environment and the company’s competitive position. Based on guidance, DHG was trading at the lofty multiple of 28x earnings. In October 2018, management substantially lowered earnings guidance by over 25% and the share price collapsed.

Source: Bloomberg

The stock continued to fall post this announcement as negative sentiment towards the housing market continued to intensify. As reporting season approached in Feb 2019, we took the decision to effectively hedge this position by buying a stake in Nine Entertainment Group, which was trading on a low multiple, but still held 20% of DHG. Following the half year result in February 2019, both stocks have rallied 20%.

Going forward

With conditions remaining volatile for equity markets, we are of the view they will create ongoing opportunities to generate return for the Fund’s investors on both the long and short side of the portfolio. We will seek to deploy individual short positions to add incremental value to overall returns. We would still expect that, over a full investment cycle, the bulk of returns will be generated from the Dynamic Fund’s long positions.

Contact us

To find out more, please contact your Key Account Manager or local Fidante Partners Business Development Manager or call the Fidante Partners’ Adviser Services Team on 1800 195 853.