Quarter in review: March 2021

The Australian market marched on over the March quarter gaining 4.2% driven by positive earnings revision, M&A and positive leads from the US market with further stimulus announced by President Biden in his first 100 days. The key drivers of the market were:

- Global vaccine roll-out ramps up despite new variants driving an increase in cases globally. As at the end of March, 590 million doses were administered globally. In terms of share of the adult population that have received at least one dose of Covid-19 vaccine, UK was 46%, US – 29% and Germany – 12%. In Australia only 600,000 people were vaccinated as at the end of March, predominantly with the AstraZeneca vaccine. The news that the AstraZeneca vaccine is linked to rare blood clotting is a clear setback to the Australian Government vaccine program and hopes of reopening the borders by year end.

- Re-opening + reflation + return to normalcy drives global growth surge on back of stimulus and loose monetary policy. President Biden was inaugurated in January and wasted no time, announcing two stimulus programmes the first of which is (American Rescue Plan) worth US$1.9 trillion has been passed and is being implemented whilst the second infrastructure bill (American Jobs Plan) totalling US$2.3 trillion programme will likely be passed in the next few months.

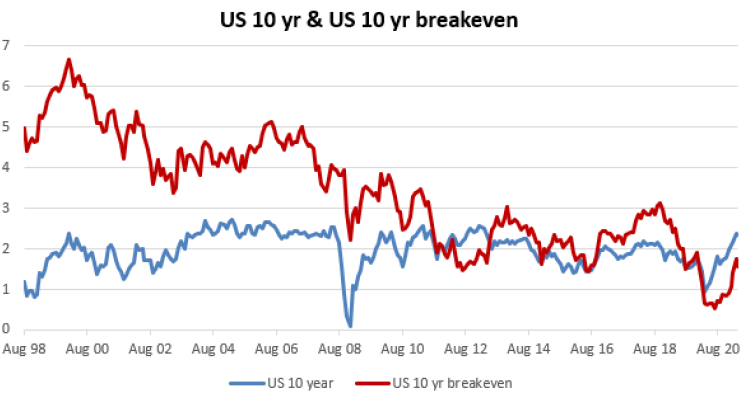

- Inflation expectations. Inflation break evens (see chart) rose dramatically over the quarter which means investors expect inflation to rise. The triple whammy of higher commodity prices, house prices and rising jobs growth suggesting the unemployment rate will fall below 5% in the US by year end has driven inflation expectations and the 10-year bond yields higher.

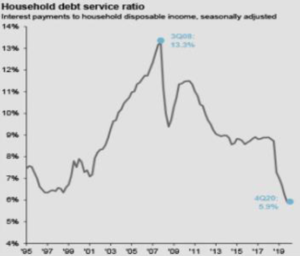

- House prices are up 6% year-on-year (yoy) in Australia and 16% yoy in New Zealand driven by record low interest rates. The collapse in mortgage rates means the debt servicing ratio has also fallen to its lowest ever level but savings rates have peaked in line with government stimulus payments rolling off.

- Reporting season drives positive earnings revisions. March was the seventh month of positive earnings revisions for the Australian market. Following the reporting season in February, analyst forecasts for market earnings growth for FY21 moved from 7% to 22% driven mainly by Banks and Resources. The IT sector saw the largest reduction in earnings forecasts (-50%) with disappointing results from Altium, Appen and Afterpay.

- M&A activity picking up. Corporate balance sheets are strong and we expect ongoing M&A activity as management teams look to grow their businesses. Deals announced recently include Computershare’s acquisition of Wells Fargo’s Corporate Trust business, REA’s takeover bid for Mortgage Choice and Blackstone’s conditional bid for Crown.

Detailed Fund commentary is available to our subscribers via the form below.