Quarter in review: March 2020

The COVID-19 pandemic delivered equity investors the worst quarter since 1987. The Australian equity market was down ~23% for the quarter. The best performing sector for the quarter was Healthcare (-4%) with CSL claiming the #1 stock in the ASX300 for the first time. Here is a short summary of key events and market movements over this extraordinary quarter:

- January started with the promise of a better new year globally with China and the USA agreeing terms on a Phase 1 trade agreement, Brexit was signed and there was optimism about a turnaround in the global economy. Australia had a horrendous bushfire season which burnt millions of hectares, damaged property and filled our cities with smoke causing global condemnation.

- A pneumonia of unknown cause detected in China was first reported to the World Health Organisation (WHO) Country Office in China on the 31st December 2019. The coronavirus was officially named “COVID-19” on 20th February and was declared a global pandemic by WHO on March 12th. By quarter end nearly 1m people globally had been infected.

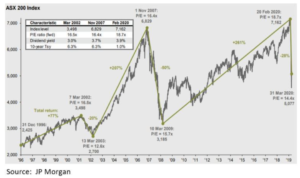

- The Australian market peaked on the 20th February andthen had the sharpest sell off since 1987 falling over 30% in 11 trading sessions. Volatility was at a historic high with the VIX at levels not seen since the GFC.

- The Australian government’s response initially focused on bolstering the health sector to manage the public health crisisas well as getting Australians home from overseas before the borders were closed. As the crisis deepened and many economists predicted a recession the amount of stimulus promised to support the Australian economy escalated. All up including monetary responses such as the RBA small business loan support, the Jobkeeper program and other welfare payments, the government will spend around 16% of Gross Domestic Product which is an unprecedented response to support the economy and Australians through the crisis.

- The Reserve Bank of Australia (RBA) also cut the cash rate twice to 25 basis points and started Quantitative Easing promising to buy unlimited government and semi-government paper. On the back of this the RBA announced it would target 3-year government paper at a rate of 0.25% which will help lower funding costs across the economy. In line with global bond markets, the 10 year Australian government bond also hit a record low of0.61%!

- The Australian dollar cushioned the blow for exporters as it fell from 70c at the beginning of the quarter to 61c. Commodities were mixed with iron ore prices only down 10% over the quarter due to Vale supply issues and the WA cyclone season curtailing production despite economic growth plummeting in China. The safe haven of gold was up 10% over the quarter whilst economically sensitive copper fell 20%.

- The oil price more than halved over the quarter to US$23 with not only a large demand shock from COVID-19, as cities globally went into hibernation, but a supply shock from the Saudis and Russians not agreeing to production cuts.

- Equity raisings began with Cochlear first off as Australian corporates caught by the exogenous shock are tapping the stock market to fix their balance sheets. At this stage we do not expect the same level of raisings as the GFC due to the bank’s having three times the capital, ample liquidity and the regulator’s preference for banks to reduce dividends to support lending and therefore the economy.

Detailed Fund commentary is available to our subscribers via the form below.