Quarter in review: March 2019

The Powell pivot and Chinese stimulus in January led the market to rebound strongly from the December quarter sell off. The ASX 300 was up 10.9% almost keeping pace with the MSCI World index up 11.6% but underperforming the US S&P500 which was up 13.1%.

The best performing sectors in the ASX 300 for the quarter were Information Technology up 20.7%, Materials (iron ore and gold) up 17.8% and Communication Services up +16.9%. The underperforming sectors were Consumer Staples up 5.0%, Financials ex property up 6.0% and Healthcare up 6.0%.

The key issues for the quarter were:

- Powell Pivot – the Fed’s focus on deteriorating economic data saw the Federal Reserve Governor pivot from two rate hikes in 2019 to on pause. On top of this the market was also given a schedule for ending the Fed’s balance sheet contraction – September 2019 at US$3.7tn. In response we witnessed a global bond rally with the US 10 year yield down to 2.4% from 2.7%.

- Tariffs and Trade Wars – Deal or no Deal? US and Chinese trade tensions dominated headlines as both sides negotiated in good faith but no agreement has been reached. Sticking points to a deal appear to be the enforcement mechanism, Chinese government subsidies of new growth industries such as electric vehicles and robotics as well as entry into Chinese markets for US companies without forced technology and data transfer. Chinese officials want everything agreed before the signing ceremony as they do not want a repeat of the “no deal” Trump / Kim Jong-un meeting in Singapore.

- Chinese stimulus to maintain growth as exports slow – see separate note from Raaz Bhuyan’s China trip. At the National People’s Congress GDP growth target was softened to 6-6.5%. During the quarter value-added tax (VAT) was cut, property in lower tier cities was stimulated and credit policies were loosened to offset the tariff impact.

- Vale woes boost iron ore price – the iron ore price was up 26% to US$86.90 as Vale had another tailing dam disaster which has shut down approximately 70m tonnes of capacity. Cyclones in WA also impacted RIO and BHP’s production.

- Elections – 2 down 1 to go – with the two largest states in Australia, Victoria and NSW returning their incumbent governments back into power the infrastructure boom can now resume.

- Royal Commission into Misconduct in the Financial Services industry Report – was delivered by Commissioner Hayne making 76 recommendations to the government. Both political parties were quick to all but rule out any change to mortgage commissions which would have been a win for the banks. Following on from the leadership changes at AMP, IOOF and CBA, NAB was next with both the CEO and Chair departing following criticism from Hayne. The positives from the report were no material change to responsible lending laws. The longer term negatives are the regulatory environment has changed to litigate first then ask questions, potential change to the renumeration of executives which given the companies are listed and capital market dependent could clash with shareholder interests and finally Hayne’s command of follow the law or face jail time has seen a significant tightening in consumer credit.

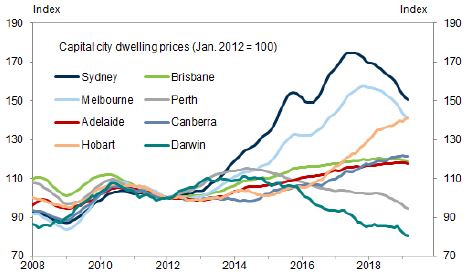

- Reserve Bank of Australia shifts to neutral bias as Sydney and Melbourne house prices continue to fall – according to CoreLogic median Sydney house prices are down 10.9% in March whilst Melbourne house prices are down 9.8% year on year to March 2019. Further pressure on the investor market could come from proposed changes to negative gearing should the Labor party win government in the upcoming Federal election. A prolonged period of falling house prices is likely to have a negative wealth effect and could impact consumer confidence and spending.

Source: CoreLogic, Goldman Sachs Global Investment Research

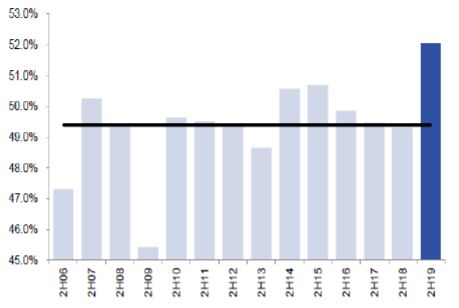

February reporting season was oh so special as companies announced over $14bn of special dividends and off & on market buybacks including FMG, WES, and WOW. On balance aggregate operating results skewed to negative earnings revisions with an uneasy increase in membership to the second half club. Resources had better than expected results with positive earnings revision.

ASX 200 Industrials; typical 2H EBIT contribution through time

Source: Goldman Sachs

Detailed Fund commentary is available to our subscribers via the form below.