Quarter in review: December 2021

The December quarter delivered a positive market return of 2.2% thanks to a late Santa rally. The market wrestled with rising inflation and the new Omicron variant sweeping the globe. The key drivers of the market were:

- Covid-19 continues to surprise: Omicron was first reported by the South African Government to the World Health Organisation on 24 November 2021 as a variant of concern and quickly replaced Delta as the major COVID-19 variant globally due to its high transmissibility. Cases have surged but it is a milder variant of disease and the rate of vaccination is higher therefore now resulting in the rate of hospitalisation and death being lower.

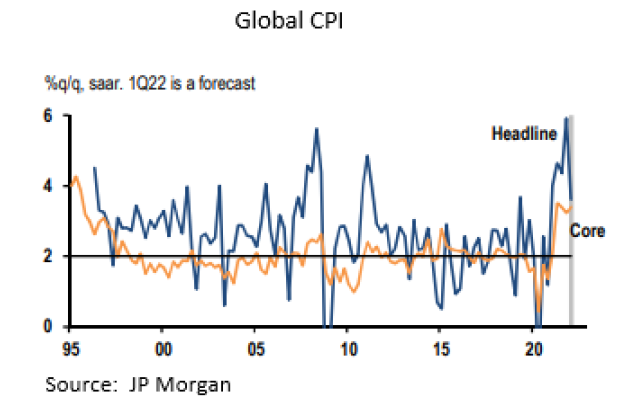

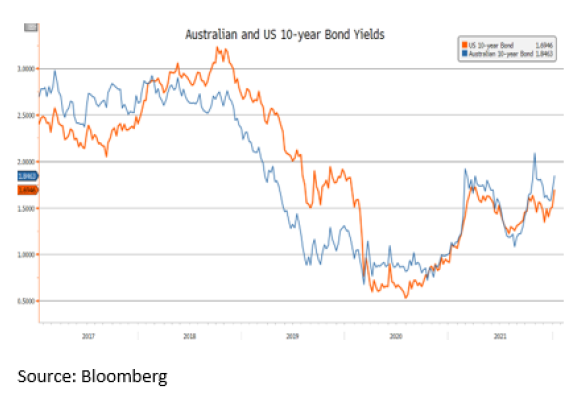

So far Governments have introduced limited restrictions and we have also not seen the same “lockdown” impact on the global economy as we have in previous waves. - Inflation watch and Yields: US inflation for November was slightly higher than the market was expecting at 6.8% year-on-year (yoy) whilst ex food and energy was in line at 4.9%. This is the fastest rate of inflation since 1982. Despite this, US and Australian 10 year yields remain relatively flat over the quarter with +7bp for the US 10 year to 1.51% and -2bp to 1.67% for Australian 10 year yields as some economists believe inflation is near its peak as energy prices especially natural gas prices have retraced whilst the WTI oil price is up 52% for the year to US$75 it has declined from its October high of US$84.55.

- Sector Performance: The best performing sectors for the quarter were Materials up 12.7%, Utilities up 11.4% and REITS (Real Estate Investment Trusts up 9.2%. Materials were led by the lithium stocks as Chinese lithium carbonate prices surged through US$40,000 a tonne in December as the Chinese battery makers were prepared to pay a 30% premium to the global price as well as a rebound in BHP, RIO and FMG as iron ore prices bottomed and subsequently rallied into year end. Utilities was driven by M&A activity with a bid for APA and Origin Energy selling a portion of APLNG whilst REITS were strong on earnings upgrades from Charter Hall and Goodman Group. The worst performing sectors were Energy down 7.5% as the new Omicron COVID-19 wave late in the quarter introduced risks to the ongoing recovery in oil demand, IT index down 4.6% as US regulators announced an enquiry into the BNPL sector and Financials down 1.7% on the back of weaker results from WBC and CBA.

- Australian Economy: The Reserve Bank kept official interest rates on hold at 0.1% with Governor Lowe reiterating that the RBA will not increase the cash rate until actual inflation is sustainably in the 2-3% target range. Current key economic data: inflation at 3%, unemployment at 4.6% and GDP growth at 3.9% annualised including -1.9% for the Covid lockdown in the September quarter. On monetary policy the RBA continues to purchase $4 billion of government securities a week until at least mid-February 2022 to support economic activity. In Governor Lowe’s latest speech on 16 December before the Omicron case surge he said “we do expect the positive momentum through the summer, underpinned by the opening up of the economy, the high rates of vaccination, significant fiscal and monetary support and the strengthening of the household and business balance sheets.” He also noted the Omicron outbreak could interrupt the recovery and the RBA would reassess in February. The Reserve Bank is concerned about booming home values as seen by a 25% surge over the past year and supported APRA’s decision in October to increase the serviceability ratio by 0.5% to at least 3.0% points above a customer’s loan product rate.

- Commodities: Energy prices exhibited heightened volatility through the quarter. Chinese efforts to improve domestic coal production and secure their own energy supply gained traction, resulting in a sell-off in coal prices from recent all-time highs. Meanwhile, fears that the new Omicron COVID-19 strain would derail global energy demand saw oil prices tumble back under $70 through late November, before stabilising towards year-end as fears ameliorated. Iron ore prices continued to slide, bottoming at $88/t in mid-November, but rallying into year-end to near $120/t on the back of monetary easing in China and expectations of further fiscal support through 2022 that would lead to better demand. While on the supply side, major producers continued to report relatively weak production data and higher cost lower grade producers have wound back production in line with the recent step-down in prices. Industrial metals continued to perform well as demand remained strong and supply issues persisted with the exception of aluminium which eased on the back of production restrictions being relaxed in China as energy prices there fell. Future facing commodities such as lithium and rare earths rallied significantly as the energy transition gathered pace, overwhelming on supply from existing mines and moving to levels that incentivises new projects.

- Global Markets: Australian stocks lagged the strong performance by global equity markets (MSCI 7.9%) after outperforming the global pullback in the September quarter. Offshore markets were led by the S&P500 up 11% and Nasdaq up 8.5% led by the megatechs as there was a large sell off in unprofitable technology stocks. China’s Shanghai Composite was flat whilst the Hang Seng was down 5% dominated by the collapse of China’s largest property player, Evergrande with over US$300bn of liabilities. In response the People’s Bank of China (PBOC) injected $188bn of liquidity into the banking system by again cutting the amount of cash banks must hold in reserve.

- Takeovers and M&A: An ongoing theme in 2021 with the December quarter seeing Brookfield bid $17.8bn for APA, CSL bid $16.4bn for Vifor Pharma group and Transurban and its Sydney Transport Partners consortium paying $11 billion for NSW’s 49 per cent stake, to take its WestConnex ownership to 100 per cent. Finally, Blackstone increased its bid for Crown to $12.50 cash.

Detailed Fund commentary is available to our subscribers via the form below.