Preparing for the risks around Climate Change is key to the future viability of insurers

According to the Australian Bureau of Meteorology, 2019 was the hottest and driest year on record. One of the worst bushfire seasons in Australia’s history was followed by extreme hail and flood events. Globally, 2019 was the second hottest year on record, while five of the warmest years (1880–2019) have all occurred since 2015[1] The increase in these extreme weather events is evidence of the impact of climate change on the global weather system. This presents a significant physical and transition risk for the general insurance sector.

Climate change directly impacts general insurers due to the physical damage to property arising from extreme weather events. This has been evident over the last few years with an increasing incidence of cyclones, floods, bushfires and hailstorms. If these claims are not adequately provisioned for by insurers, the general insurance sector may not be able to provide for the perils losses that will eventuate.

Australian insurers approach to climate change

The major bushfire event of 2019/2020, referred to as the ‘Black Summer’, together with seasonal floods and hailstorms, has brought into stark focus the role of climate change in perils losses. As at August 2020, the Insurance Council of Australia has confirmed that the industry had received more than 297,780 claims from last summer with losses of almost $5.4 billion. This included four catastrophic events during ‘Black Summer.’ Prior to this, insurance specialist AON note that the most expensive bushfire season was in 1986 with losses amounting to $1.76 billion.

The substantial increase in claims due to natural catastrophes demonstrates the urgency on the part of insurers to understand and mitigate the short and long-term causes and impacts of climate change, including the impact of physical and transition risks on insurance and reinsurance forecasting.

Indirect risks from climate change such as the increased frequency of pandemics also need to be included. The Intergovernmental Panel on Climate Change (IPCC)[2] will provide detailed analysis on the link between climate change and pandemics in their 2021 report. Habitat loss and the increase in the movement of people due to climate change has led to increased interactions between humans and animals.[3] It is predicted that the frequency of pandemics and infectious diseases will increase. In addition to the human toll, this impacts the insurance sector. The rate of business interruption claims as a result of Covid-19 is likely to increase in 2020 due to a recent NSW Court of Appeals decision in favour of policyholders.[4]

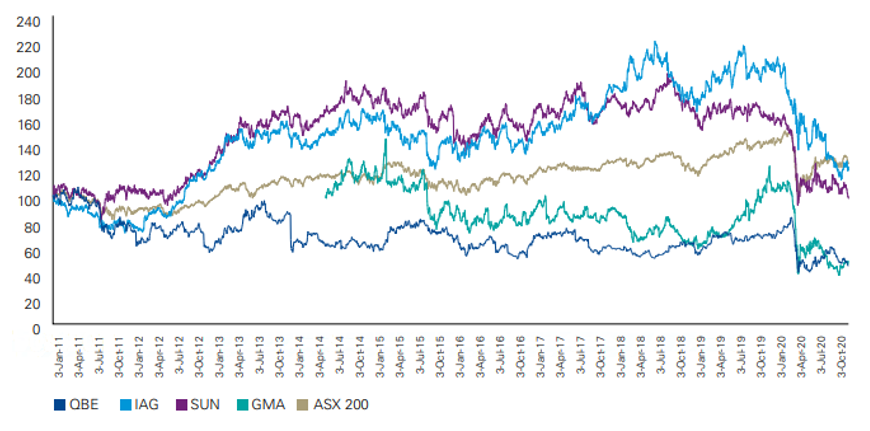

Historically, Australian general insurers have consistently under provisioned for perils and this has come at a cost to shareholders

According to the KPMG General Insurance Industry Review 2020, insurance sector profits have declined by 48.3% in 2020. KPMG note that severe natural hazard events at the beginning of 2020, higher reinsurance costs and unfavourable investment returns are the cause of this decline. In the FY20 reporting season, the best performing general insurers were those that factored higher annual hazard and reinsurance costs into their modelling. Despite the differences in relative performance, all Australian listed insurers have seen a decline of at least 10% in the period 1 July 2019 to 31 October 2020.

Insurance companies’ performance since January 2011

Source: KPMG General Insurance Industry Review 2020

How insurers can respond to the risk of climate change

If insurers do not adequately consider and model both the direct and indirect physical risks of climate change, and associated transition risks, they may not be able to meet the increasing demand for insurance and reinsurance on perils and this will ultimately affect their shareholders over the medium-long term.

Insurers can meet the challenge of climate change head on by taking some key actions:

- Develop better climate catastrophe modelling to improve the risk management across the insurance and reinsurance sectors

- Report exposure to climate risk under the Taskforce for Climate Related Financial Disclosure (TCFD)

- Consider climate risk and carbon exposure across investment portfolios

- Set carbon emissions targets that are aligned to Science Based Targets Initiatives

- Cease providing financial services to the large carbon emitters in the thermal coal, oil and gas industries. Many of the large insurance companies in Australia have committed to not invest in or insure any new thermal coal projects and phase out insurance to existing thermal coal clients.

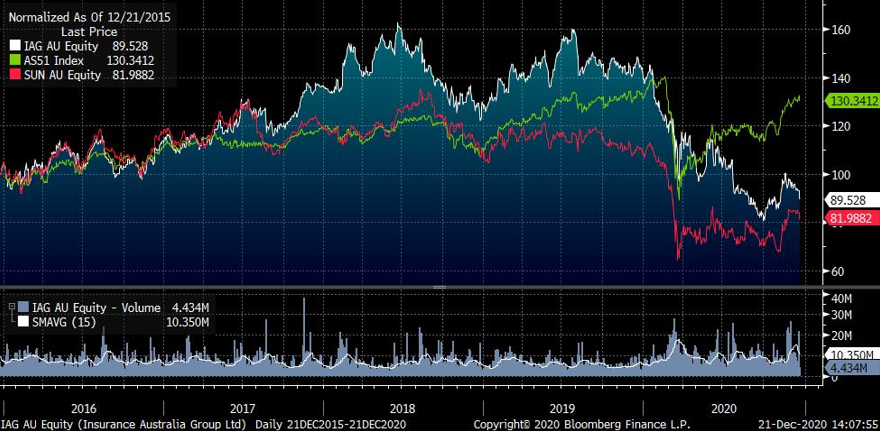

Insurance Company Spotlight – IAG

IAG is an example of an insurance company that is tackling the physical and transition risks of climate change. We have invested in IAG in the WaveStone Australian Share Fund. Whilst COVID-19 has caused business interruption and led to additional claims for general insurers, IAG has been at the forefront of assessing its approach to climate change. Their disclosures are aligned with the recommendations of the TCFD and address how they are managing their risks and opportunities through Governance, Strategy, Risk Management, Metrics as well as Targets. IAG want to manage their greenhouse gas emissions with comprehensive science-based targets to reduce scope 1 and 2 emissions across the IAG Group to meet its Paris Agreement commitments to keep climate change below 2 degrees. With a Climate Action Plan, IAG have a framework to help mitigate and address the impacts of climate change.

IAG Performance as at 21 December 2020

Source: Bloomberg, 21 December 2020

IAG have been carbon neutral since 2012 and have set science-based emission targets for scope 1 and 2 emissions to meet the Paris Agreement commitments. Using FY18 as a baseline, the targets are a 20% reduction by 2020, 43% by 2025, 71% by 2030 and 95% by 2050. In FY20 IAG have achieved their 20% reduction target.

IAG Science-based target

Source: IAG’s emissions performance against its Science-Based Targets, IAG climate related disclosure report, 2020

The company has shown considerable leadership in this area, releasing a report in November 2019 on Climate Change in Australia, co-authored with the US National Center for Atmospheric Research (NCAR). This body of work is used by IAG to deliver better pricing and engage with the community on severe weather challenges.

IAG has committed by 2023 to cease underwriting those businesses whose primary activity is extracting fossil fuels. As of 30 June 2020, the Gross Written Premium (GWP) related to fossil fuel was estimated at less than $1million.

IAG commissioned Ernst and Young (EY) and Climate Works Australia to undertake a Climate Transition Analysis to better understand the implications for its business from transitioning. The findings identified that while there are some risks to smaller underwriting portfolios (such as Agriculture) in the medium term, the risk to supply chain costs through carbon pricing was relatively immaterial. There are potential risks attached to court cases from a duty of care perspective, evidenced in the current court cases against companies for failing their duty of care on climate issues. This confirms IAG’s position that climate change is not just a physical or transition risk to a company but can also be a reputational risk.

Conclusion

2020 was a watershed year for climate change in Australia. Within the general insurance sector, insurers faced the full impact of the physical risks of climate change due to the claims from the four catastrophic events in the ‘Black Summer’ of 2019/2020. The financial impact of these large-scale events provided a harsh insight for the general insurance sector and its shareholders into what the future may look like if climate change isn’t adequately addressed. However, if the largest insurers tackle the challenge of climate change head on and take meaningful action, like IAG, insurers will not only be able to sustain the perils losses arising from climate change but will provide longevity for the sector and stability for the economy as a whole.