Investing in China – playing the long game

“Just as distance tests a horse’s strength, time will show a person’s sincerity.” Xi Jinping quoting a Chinese proverb in a speech in Mexico in June 2013

Australia’s long-term prosperity is inextricably linked to China successfully achieving its goal of becoming a prosperous (high income) country by 2049 when the Party celebrates 100 years of its rule. In this series of articles, we identify some of the businesses and sectors that we expect will prosper from the changing dynamic in China.

The journey so far

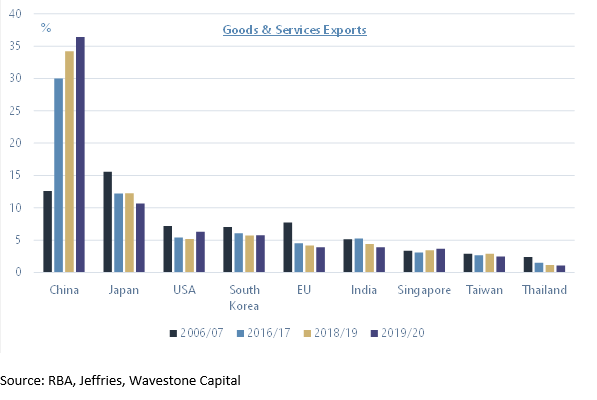

As shown in the chart below, China is Australia’s most important trading partner, and this will continue over the coming decade.

Figure 1: Australia’s goods and services exports

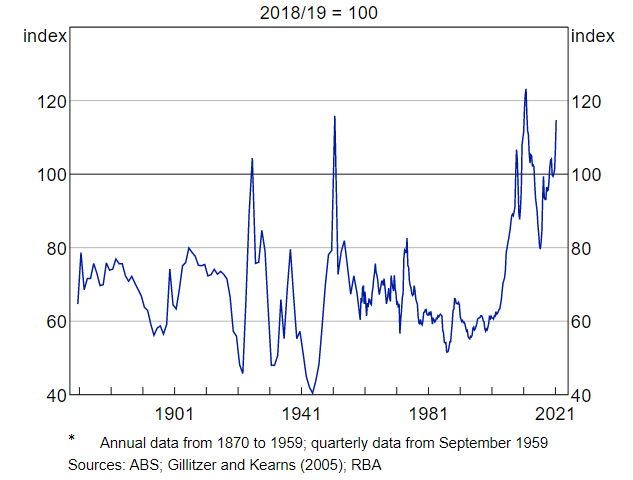

As an open economy with significant commodity exports, Australia’s terms of trade remain favourable. This has been a significant factor helping Australia weather the impact of the pandemic over the past 15 months.

Figure 2: Australia’s Terms of Trade*

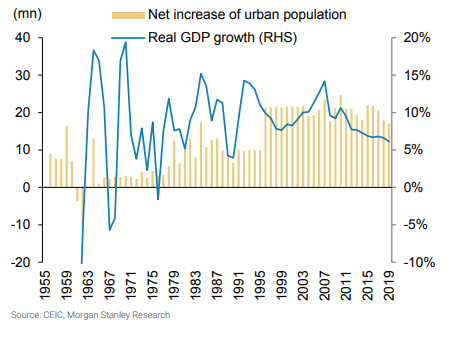

China has been the largest contributor to global growth over the last decade, cumulatively accounting for close to 50% of growth. Rapid urbanisation has led to millions of people moving from rural areas to cities which has dramatically increased Chinese demand for materials. Currently, China accounts for over 50% of the world’s steel consumption.

Figure 3: China’s GDP growth vs. urban population growth

Figure 4: The rise of China in global steel production

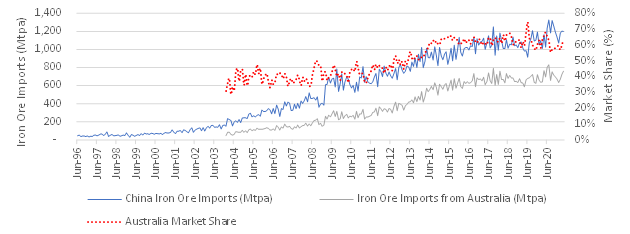

Australia’s rich endowment of high-grade iron ore, a significant raw material in steel making, has led to a strong correlation between China’s steel demand and Australia’s economic growth.

Figure 5: Australia has benefitted the most from China’s insatiable appetite for iron ore

Source: WaveStone Capital, Bloomberg

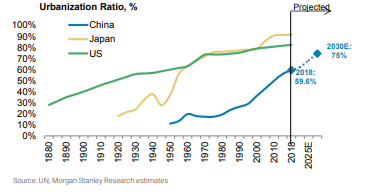

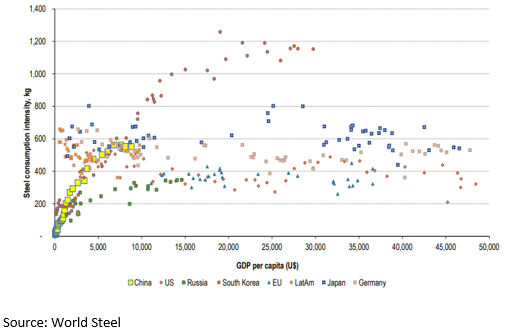

China has amassed an inventory of steel (capital stock) over the past few years which is likely to lead to slower demand growth over the coming decade but with absolute demand remaining elevated. The next phase of China’s urbanisation will focus on the development of planned urban clusters and smart interconnected cities. One of those is the Guangdong-Macau-Hong Kong Greater Bay Area (GBA) which comprises 11 cities with 72m people and accounts for roughly 12% of Chinese GDP. Morgan Stanley expects there will be four other key city clusters across the country – Yangtze River Delta, Jing-Jin-Ji Area, Mid-Yangtse River Area and the Chengdu-Chongqing Area, with the urbanisation ratio expected to match the US and Japan in the next decade.

Figure 6: Sustained pace of urbanization towards 2030

Figure 7: Per capita consumption trends in major steel consuming markets (1960-2017)

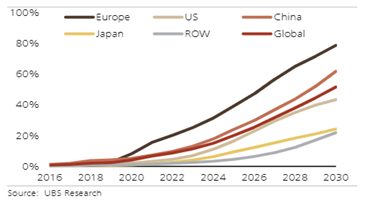

As China embarks on Urbanisation 2.0, there will be a concurrent shift taking place with sales of internal combustion engine automobiles increasingly replaced by electric vehicles. China has exceeded its targets for electric vehicles (EVs) already and estimates range from 30-50% of new car sales by the end of the decade. The main commodities likely to benefit from increased EV penetration are nickel, lithium, cobalt, copper and rare earths.

Figure 8: EV penetration rate

A changing consumer landscape is the big prize

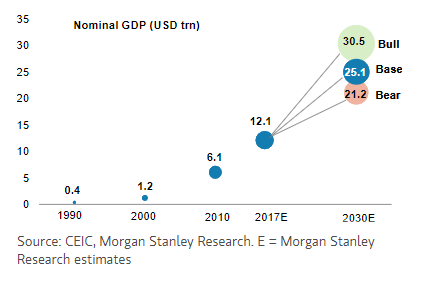

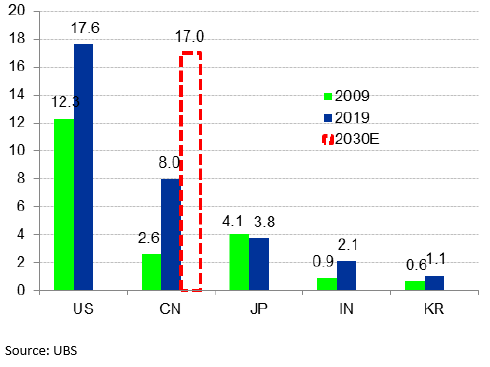

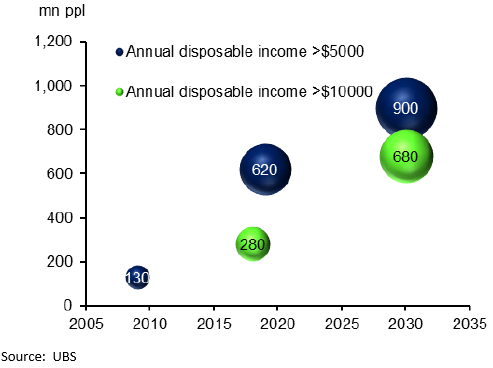

As investors, we aim to identify companies that can sustainably benefit from consumer growth, especially the potential doubling of the size of the consumption market to $17trn by 2030, which is similar to the current size of the US market. UBS estimate that almost 700m Chinese people will have an annual disposable income of more than US$10,000 by 2030. Morgan Stanley estimate China’s nominal GDP to reach US$25trn by 2030.

Figure 9: Nominal GDP to reach US$25.1trn by 2030

Figure 10: Global consumption markets – total (USD trn)

Figure 11: Annual disposable income in China

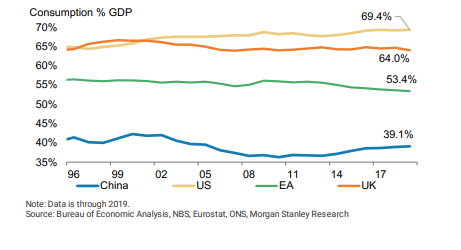

The savings rate in China is very high, largely because of the absence of a strong social security net. As the economy matures, we expect the Chinese government will develop social security mechanisms as well as providing social services like healthcare. This will reduce the need for precautionary savings and help unleash the power of the consumer. Income growth should be strong as the working age population falls and industrial automation and technology leads to higher paying jobs.

Figure 12: Consumption % GDP

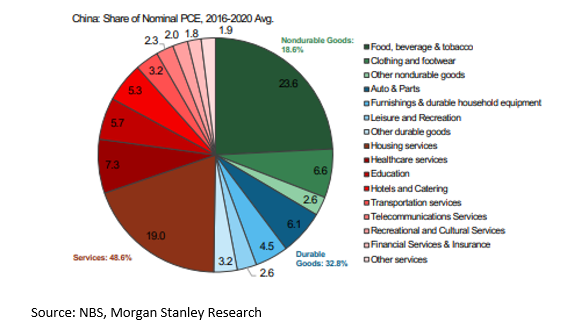

Comparing the spending patterns of Chinese consumers with US consumers helps to identify future opportunities.

As shown in the charts below, the Chinese consumer spends significantly more on daily necessities (staples) and durable goods than US consumers. US consumer spending on services is around 65%, which is significantly higher than Chinese consumers, at 49%. Whilst there will always be significant structural differences between the two countries, we expect Chinese consumers to increase their spending on discretionary goods and services in the years to come.

Figure 13: Composition of US Consumption

Figure 14: Composition of China Consumption

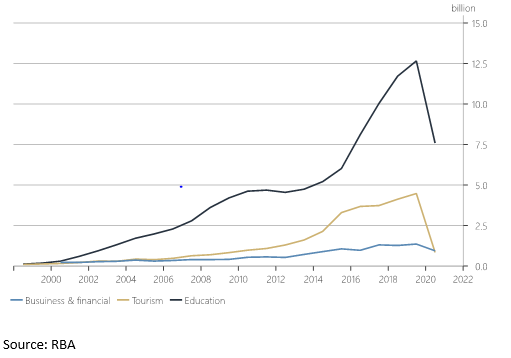

A shift from the consumption of goods to services will be extremely positive for locally domiciled companies. Australia will also benefit, particularly from the growth in service-related exports, mainly tourism and education. Whilst border closures over the last year has meant that services exports have fallen, we expect this to normalise and grow once borders re-open in 2022.

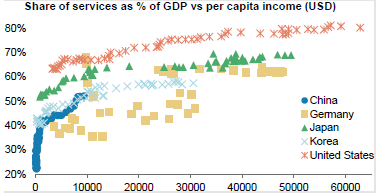

Figure 15: China’s services share of GDP to rise further with increased per capita income

Source: CEIC, Haver, Morgan Stanley Research. Data as of 1962-2018 for China and the US, 1965-2017 for Japan, 1972-2018 for Germany and 1970-2018 for Korea.

Figure 16: Australian service-related exports to China (calendar year, AUD)

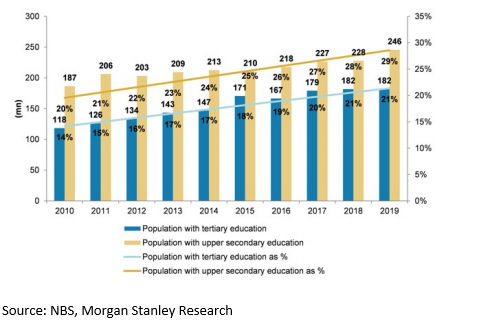

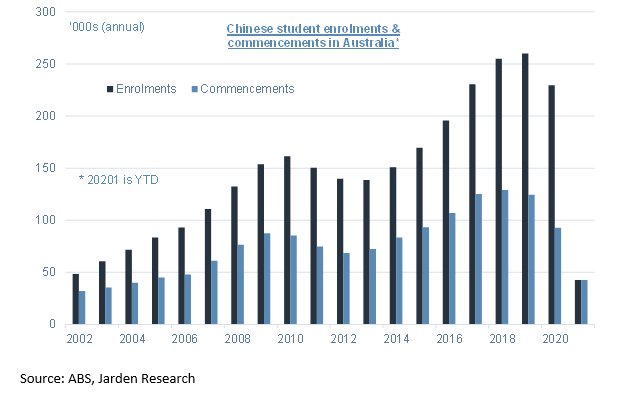

Tertiary education will become a priority for China as the working age population shrinks. Increasing automation and technology will also drive demand for tertiary qualified workers. As one of the main overseas destinations for Chinese university students, we expect that Australia, and companies such as IDP Education will continue to benefit.

Figure 17: Population by education attainment in China

Figure 18: Chinese student enrolments and commencements in Australia

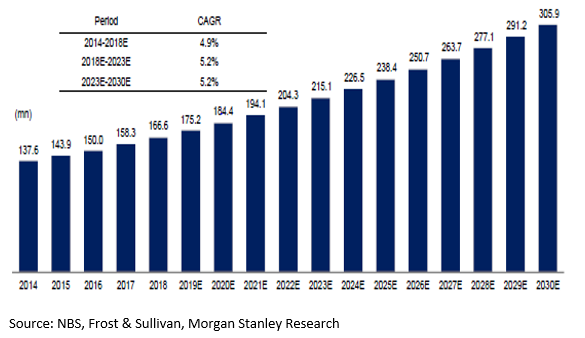

Demographic shifts will lead to a significant increase in healthcare spending. Based on current estimates, China’s elderly population (those over 65 years) will grow from 110m people to over 300M in the next decade.

Figure 19: The number of people aged ≥65 will continue to increase rapidly in 2019-30E

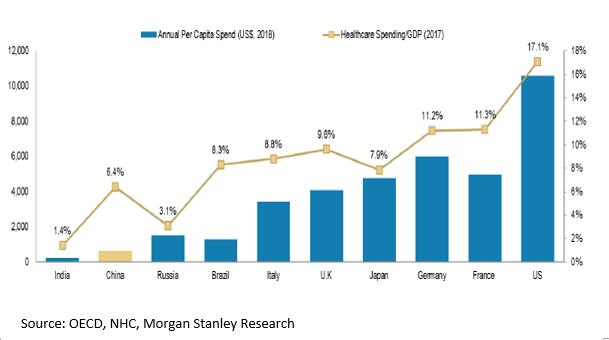

Consumer spending on healthcare in China is still quite low relative to the Western countries. Long term, healthcare providers will benefit from this aging demographic as well as growing wealth in China. Similar to other countries, the sector is heavily regulated with high barriers to entry due to the intellectual and human capital involved. All our investee healthcare companies consider China to be a strategic opportunity and have been operating there for a long time.

Figure 20: Global consumer spending on healthcare

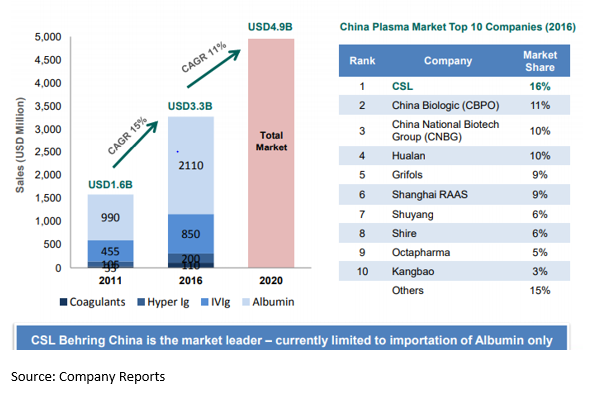

Figure 21: China plasma market has been growing at 15% per year

For example, CSL has been importing albumin into China for over 30 years and is the largest supplier of imported albumin. Sales are over $600m which represents less than 10% of group sales. CSL completed the acquisition of Chinese plasma fractionator Ruide in June 2017 for US$454M. This facilitated the transition to a direct trading business model, allowing them to work with clinicians in China. Given the size of the potential market, we expect that China will become a significant part of CSL’s overall business in the future.

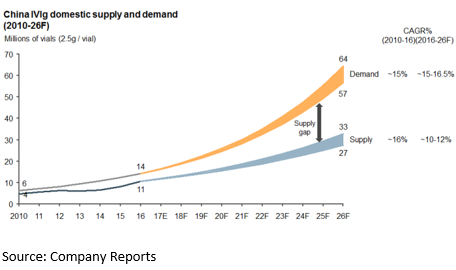

Figure 22: Demand for Immunoglobulin is expected to significantly increase in the future

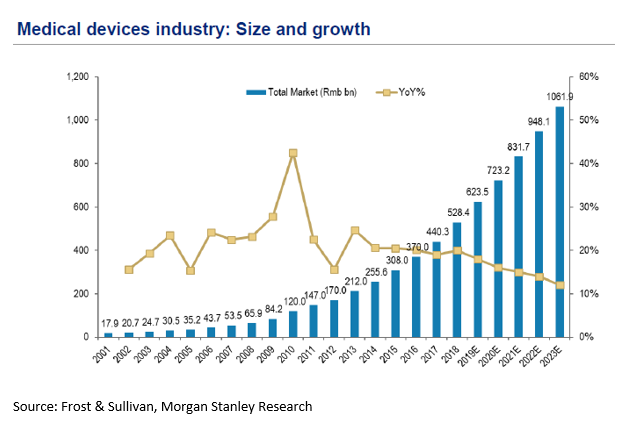

WaveStone funds also have exposure to global leading medical device companies such as Cochlear, Resmed and Fisher & Paykel Healthcare. Although penetration of the medical device sector in China is low currently, it is likely to escalate as spending on healthcare increases.

Figure 23: Medical devices industry – size and growth

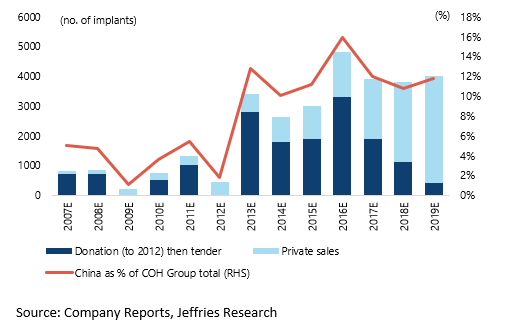

Cochlear has had a presence on the ground in China for over 20 years. The company committed to building a manufacturing facility in Chengdu in July 2017 producing cochlear implants for China and emerging markets. China is already one of their top five markets and is one of its fastest growing. The Cochlear implant market is China includes the open market (private pay market), a tender market supported by the government and a ”donation” market. Based on Chinese government data, there are 30,000 babies born with severe or profound hearing loss every year. As wealth increases, we expect cochlear implants to become standard for these babies. There is also likely to be a large adult market for implants in time.

Figure 24: Cochlear implant sales

Summary

Whilst we expect that the Australian resources sector will remain a key beneficiary from the continued growth of the Chinese economy, the opportunities across sectors are becoming broader. China’s priority has pivoted from being a manufacturing export powerhouse to focusing on the domestic Chinese consumer market. As wealth increases, household spending shifts from necessities to discretionary items. This transition and the sheer size of the population presents opportunities for investors. WaveStone’s investment process involves identifying businesses with a Sustainable Competitive Advantage. Many of these are global franchises whose success is leveraged to global growth, emerging themes and changing consumer preferences such as healthcare, tourism and education. Correctly identifying those long-term trends provides attractive investment opportunities.