Insights From The Road Well-Travelled

This article was first published on FN Arena

WaveStone Capital’s Henry Hill has visited 50 UK and US companies to gauge the mood post-covid and the impacts of inflation and a slowing consumer

- Covid pull-forward impacts still being felt

- The price of everything is going up

- Consumers still spending, for now

- Northern winter looms

By Henry Hill, deputy portfolio manager, WaveStone Capital

It may seem odd that an Australian equity manager would spend the time visiting over 50 companies in San Francisco, New York and London. However, site visits with our investee companies as well as meetings with suppliers, customers and competitors provide powerful insights that aid our analysis of a company’s sustainable competitive advantage. It can also give us a better understanding of what is happening in the end-markets for many Australian goods and services, particularly in the current uncertain macro environment.

A few consistent themes emerged. Below we elaborate on those we think will be most relevant for investors in the coming 12-18 months.

COVID reversion continues

Companies that struggled during covid are booming, while those that were covid beneficiaries are continuing to see a decline in demand. Just as covid winners saw higher than expected demand for longer, they are now seeing a deeper downturn than expected as mean reversion takes hold. We estimate Australia is 6-9 months behind the Northern Hemisphere in this regard due to the timing of lockdowns.

Spending on out-of-home activities – cinemas, hotels, bars, restaurants and flights – remains buoyant, well after the end of lockdowns, with consumers showing little to no price elasticity. The December quarter will be interesting given the rising cost of energy as we enter colder months in the Northern Hemisphere. This could lead to a reversion to the mean in travel and entertainment spending.

On the flip-side, there is a sustained hangover for companies that benefitted from covid. Demand pull-forward in 2020 and 2021 continues to weigh on 2022, and declines, while now at a slower rate, have not subsided. This is especially true for larger, discretionary items, which are purchased less frequently.

In our view, whether a company benefitted from extremely abnormal covid conditions is still an important lens through which to consider a business’ attractiveness as an investment, at least for the next 12 months.

Prices are going up everywhere for almost everything

Whether to cover elevated costs or take advantage of consumers’ awareness of inflation, companies across many industries are raising prices. Management teams shared with us that across a diverse range of sectors including alcohol, groceries, concert and cinema tickets, streaming services, rent, luxury goods, semiconductors, hotels and consumer packaged goods, they are seeing price increases. Most companies we spoke to are also planning to increase their prices further in 2023.

Salary increases for many industries are running at mid-to-high single digits, with additional increments planned. This will likely increase the stickiness of price rises for some categories of goods and services.

The use of inflation rhetoric as a reason to raise prices, reflects how inflation can self-perpetuate itself into existence. Consumers begin to prepare themselves for price rises, and companies are happy to oblige. Jerome Powell addressed this phenomenon in a recent speech at Jackson Hole and referred to it as a key reason for the Fed’s tough stance on inflation.

Companies are bracing for a slowdown, but consumers are still spending

Macroeconomic uncertainty has seen companies implement hiring freezes, cut back on advertising and have a heightened awareness of the risk of a pull-back. However, in aggregate, consumption – both from consumers and small businesses — has remained surprisingly resilient. Most put this down to elevated employment levels. Lenders have seen few signs of stress apart from on the fringes.

A common refrain from companies (especially in the US) was along the lines of “we are positioned for a slowdown, but it just hasn’t arrived yet”. Trading conditions in July and August seemed to be better than May and June, which is when many companies shifted to focus more on costs.

At face value, this may be reason for optimism, however, it could also mean the Fed needs to work harder, given it sees rising unemployment as the cure for elevated inflation. This is negative for equities, even if it means earnings declines are not as severe.

Higher income consumers are doing better than lower income consumers

Higher income consumers, who are less impacted by inflation and who hold the majority of covid savings buffers, are not changing their spending patterns. However, lower income consumers who saw more benefit from covid stimulus measures are tightening their belts. US lenders in this space are beginning to see early signs of stress.

The exception to this dynamic is younger consumers. While they are typically lower income earners, they are less rate-sensitive as a cohort, and work in industries experiencing particularly high wage inflation.

Companies like Diageo and LVMH are seeing higher demand for their premium products, while mortgage brokers and lenders are seeing no drop-off in demand for higher end housing.

Winter could be a turning point for European and UK consumers

Given the rapid escalation of gas prices, most companies feel elevated power bills are likely to weigh on consumption in winter. Combined with higher grocery bills and rent, this is likely to impact discretionary incomes and spending, which has so far, held up.

While the UK and European governments have made moves to cap prices for consumers, bills will still be elevated. Notably, these caps benefit wealthier consumers with larger houses given it is a blanket cap.

Companies that have never given much thought to utility bills – typically ~1% of revenue – are now considering hedging as margins suffer. Government subsidies may help offset this to some extent, but ultimately they are not sustainable solutions.

Supply chain pressures are easing, although are not back to normal

Companies have seen supply chain bottlenecks ease, although they remain above 2019/20 levels. Most companies expect supply chains to normalise in early 2023, which could provide a slight tailwind to margins.

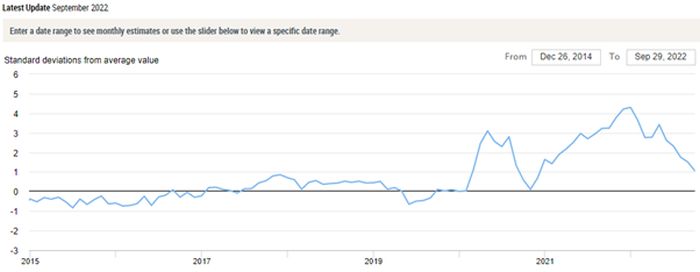

According to the New York Fed, supply chain pressures eased to roughly 1 standard deviation above long term averages in September, the lowest level since late 2020.

Source: New York Fed

With additional shipping capacity set to come online in 2023, we could see a situation where freight costs fall below pre-covid levels in the next 12 months as supply increases and demand wanes.

Labour pressures have begun also to ease in the Northern Hemisphere

Labour pressures have begun to ease in most industries as companies freeze hiring and immigration picks up. While wages are still increasing, especially in industries like retail and hospitality where shortages are more acute, supply is improving. Immigration is likely to also help domestic food supply chains run more smoothly given these jobs over index toward migrant labour.

White collar job cuts and hiring freezes should add to labour market slack and temper wage inflation.

Despite some costs easing, companies broadly expect flat-to-down margins

While logistics costs may ease, labour supply may improve and prices go up, few companies we spoke to expected margins to improve in the next 12-18 months. This speaks to the extent of wage and cost of goods sold inflation at present.

Work from home is a much bigger phenomenon in the UK/US than in Australia

Offices we visited on Mondays and Fridays were almost empty, with most companies having instigated a mandatory three days in the office policy. Companies have begun to downsize or sub-lease office space, suggesting these policies might be one of the few permanent changes to emerge from the pandemic.

The CEO of Costar, which provides data software for commercial real estate companies, said the office sector in San Francisco is the worst he has ever seen a commercial real estate market – with another two plus years of pain to come. In New York, the picture is less bleak, with A-grade office still performing well, although B and C grade sites are struggling.

In many markets globally – including Australia – office was a hot sector in the years leading up to covid, with supply additions above trend. This is likely to exacerbate the current downturn as supply will take longer to work through or be converted.

One thing to consider might be whether additional slack in the labour market shifts the balance of power back toward employers, many of whom have suggested quite openly that working collaboratively in offices is better for productivity.

The most cautious companies are those closest to the consumer

Three of the most bearish meetings we had in London were with Sainsbury’s, Unilever and Ocado. These companies are closest to the consumer and can provide insights into frequent purchase behaviour. All are seeing consumers meaningfully trading down, with a market share shift to private label products and smaller basket sizes. These are the type of companies that will see a shift in spending behaviour early, so their commentary could be a leading indicator for a slowdown in other areas.

In the words of Unilever, the consumer “can’t defy gravity forever”.