China Research Trip: 2018

Last month (Mar 19-23) we travelled to China on a company research trip. It was an interesting time to be in China with the trip coinciding with the National People’s Congress (NPC). This NPC was a very important one, with President Xi Xinping becoming the country’s ‘unrivalled helmsman’ and abolishing presidential term limits enabling him to lead China for at least another 10 years.

The main points form the trip are as follows:

“Blue Sky” policy will continue. The winter shutdown of polluting industries was successful this year – Beijing air quality was much better. This was the first year of seasonal shuts and so, the construction and materials industries are still adjusting to the inventory cycle. Given its success, there is an expectation that it may extend beyond the “2+26 cities” in future but at this stage, this is not clear. Obviously Southern China is a larger share of Chinese economic output and therefore, there are risks to that.

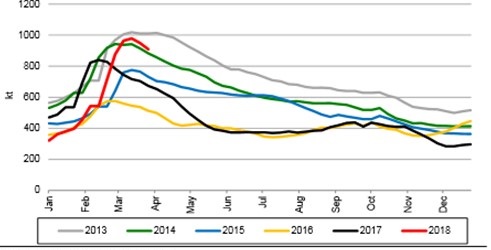

Steady demand for construction materials was the consensus. A late Chinese New Year, an all-important NPC and inclement weather meant that construction activity levels were weak. Steel rebar inventories were high – especially with traders. There was however remarkable consensus with underlying demand. “Steady” was a common theme across all the participants – downstream and upstream. Flat property, growth in infrastructure (but slower than last year due to credit tightening) and therefore, overall steel demand is expected to be flat to slightly up. The Belt Road Initiative (BRI) is expected to be additive to demand.

Steel traders rebar stocks yearly trends

Source: Steelhome, Credit Suisse estimates

Supply side reform will continue. Most steel industry players felt that the government was keen to ensure steel sector profitability to help with bank bad debts. Therefore, a fall in steel margins will likely mean more stringent supply measures to curtail output and increase industry capacity utilisation. This also dovetails nicely with the government’s focus on environmental pollution.

Recycled material, both ferrous and non-ferrous, is increasing. Whilst we have long talked about recycled material affecting primary demand of commodities, it now appears that recycled material will form an important part of the supply equation. This is probably the more negative aspect of demand for upstream products. Domestic scrap creation in copper and aluminium is starting to replace scrap imports. This is environmentally friendly policy as China stops importing rubbish from the rest of the world. The spend on the Chinese electricity grid is slowing; this has meaningful implications for end copper demand. For steel, scrap usage could see more Electric Arc Furnaces replacing Blast Furnaces which is negative for iron ore and again, perceived to be more environmentally friendly.

Residential starts will likely be flat this year. Most developers are reporting a strong start to the year but it is expected that overall, property will likely have a flat year in 2018. Shanty town housing and rental stock will play an important role in the next 2-3 years for the property sector as rural migration slows down. The government still wants to ensure better housing affordability and we expect purchase restrictions will continue in tier-1 and tier-2 cities

Infrastructure spending will remain strong. Last year, there was a great emphasis on Public Private Partnership projects resulting in a strong infrastructure spending pipeline. As most of these projects are long-dated, there will be continued demand of construction materials from infrastructure spending. The growth in order books have slowed as the government has put some constraints around bank credit growth.

And finally, new industries in the technology industry are being pushed in the very traditional ambitious and pragmatic Chinese government approach. Of particular interest is the Electric Vehicle (EV) sector as they try to get ahead of US. Much like Alibaba, Weibo, and Tencent, the government is creating an environment for new innovative firms to flourish and compete. There are over 30 EV start-ups and between 100-130 battery suppliers in China; the majority are subsidised by the government and/or funded by tech entrepreneurs. This intense competition and oversupply will inevitably commoditise the EV industry and encourage scale players to dominate the global EV industry. More relaxed autonomous driving laws in China will allow the country to be an early adopter.

Implications for the WaveStone portfolios

The portfolio currently holds exposure to resource and energy companies BHP, RIO, OSH and WPL. With commodity prices expected to remain relatively stable, the lowest cost producers are expected to generate strong cash flows. Our preference is to hold companies which have good quality management, long life assets and are in the lowest quartile of production cost.

Author: Raaz Bhuyan, Principal and Portfolio Manager